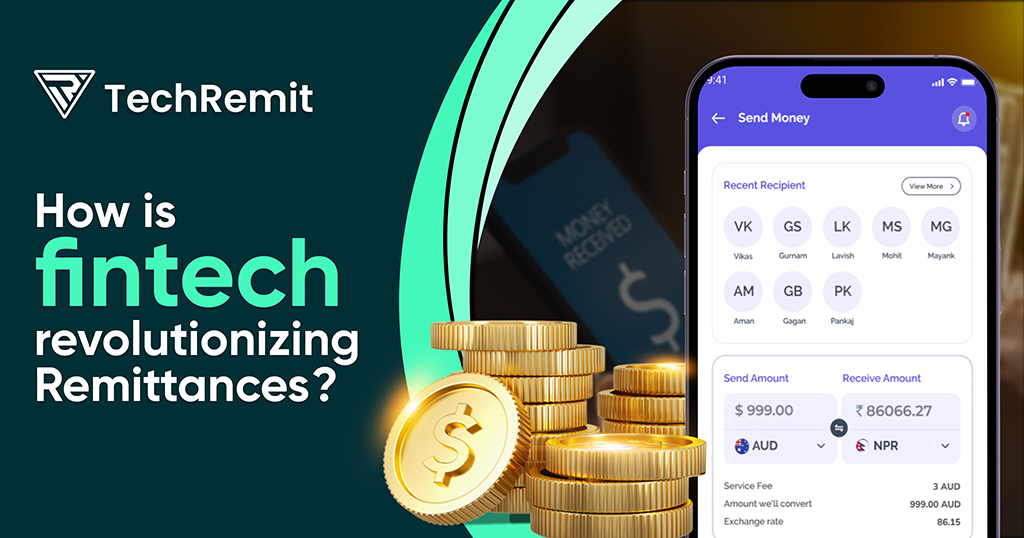

How Is Fintech Revolutionizing Remittances?

Remittance is crucial for migrant workers, expats, and international businesses to support their families or conduct global operations. However, traditional remittance systems face some challenges that have compelled the fintech companies to develop innovative tools and platforms and improve the industry in so many ways. To better understand this transformation, let’s explore how fintech is revolutionizing the global remittance industry. First, it’s important to identify the challenges faced by traditional methods of remittance.

Drawbacks Of Conventional Remittance Services

Transferring funds internationally via banks and other financial institutions turns out to be an overwhelming experience for most remitters due to the following:

- Initiating remittance requests requires remitters to take time out of their hectic schedules to physically visit bank centers, wait in line, and complete lengthy forms. Furthermore, approval can take longer, making the overall process inconvenient and time-consuming.

- Banks charge high transfer fees because successful money transfers require the participation of multiple parties.

- Banks’ pricing structures are unclear and include unfair exchange rates, hidden fees, and various unexpected deductions.

- Traditional cross-border payment services are unavailable in many regions of the world.

- Due to their lack of strong security measures, traditional cross-border payment systems are susceptible to security breaches.

- Banks and other traditional remittance service providers don’t provide clarity over the status of the transfer or expected delivery time. It causes confusion for both the remittance sender and the receiving parties.

Understanding Financial Technology (Fintech)

Financial Technology, or Fintech, is a technology that improves, automates, and transforms financial services for both businesses and consumers. It typically involves specialized software and algorithms that operate on smartphones, computers, laptops, tablets, and other digital devices. The fintech industry has transformed many financial services, including insurance, money transfers, lending, banking, and more. It helps businesses improve their financial operations, such as e-commerce, payment processing, accounting, and so on.

Role Of Fintech In Money Remittances

Fintech in remittance has turned out to be nothing but incredible for both individuals and businesses. Fintech companies have developed innovative digital payment solutions that improve the remittance experience over traditional methods in the following ways:

Quick Transactions

Earlier, people just had one option: to physically visit banks to send and collect money. Furthermore, they had to fill out paperwork and wait for multiple intermediary banks to complete the cross-border transaction. To help with this, fintech has introduced digital infrastructure and automated remittance systems that initiate, process, and complete transactions quickly. Such speedy remittances can be extremely beneficial for emergency situations like urgent family needs, unexpected medical bills, etc.

Reducing Transfer Costs

Banks usually charge 5% to 10% of the transfer amount that remitters request to another country. These high costs are primarily due to the involvement of multiple intermediaries, along with additional hidden fees that banks often impose.

In contrast, modern remittance software uses smart routing systems that eliminate the need for physical branches or agents for remittance operations, resulting in cutting operational costs. For this reason, remittance service providers charge relatively low fees for money transfers.

Enhanced transparency

Digital remittance platforms offer real-time transfer status updates along with complete transparency in the cost of the remittance service. When initiating a transfer request, these platforms show exchange rates, fees, and delivery times upfront so that the remitter has complete transparency of what they are paying for.

Additionally, remitters receive real-time notifications about the status of their transactions. It covers all phases from the start of the money transfer process to its successful completion.

Fair exchange rates

Banks often charge unfair exchange rates when transferring money to another country, significantly reducing the amount that reaches the remitter. However, remitters did not have much choice in the past and had to accept the low exchange rate set by the financial institutions.

Companies use smart remittance software to provide competitive exchange rates for their money transfer services. Their set exchange rates are relatively close to current market rates, providing remitters with better value for their money.

Secure Money Transfers

The remittance sector is particularly vulnerable to security issues as it deals with highly confidential user data and funds as well. Modern remittance systems are secured using advanced security protocols like multi-factor authentication, fraud detection systems, data encryption, and more to secure against unauthorized access and cyberattacks.

Integration of Digital Wallets

Digital wallets have turned out to be extremely useful for both local and international money transfers. Remittance software integrated with digital wallets enables money transfers to rural or relocated areas where bank transfers are not possible. These digital wallets support secure storage, sending, and receiving of money without the involvement of traditional banks. As a result, this fintech innovation improves the security, convenience, and speed of cross-border payments for both businesses and migrants.

Blockchain and Cryptocurrency Options

Blockchain technology is transforming the remittance industry by enabling peer-to-peer (P2P) transfers that are fast, secure, and transparent. Unlike traditional systems that rely on banks and other intermediaries, blockchain-based platforms use a decentralized ledger to record transactions that cut operational costs and delays. These systems leverage cryptocurrencies and smart contracts to facilitate cross-border transfers in near real-time.

Conclusion

Financial technology has transformed money remittances, all for good reasons. What used to be cumbersome and slow systems are now being replaced by quick and convenient digital solutions. We at Tech Remit aim to bring the latest fintech innovations to the remittance space by developing robust software solutions that facilitate secure, efficient, and transparent cross-border payments. Contact us to learn more about our services.

Also Read : The Pros and Cons of Peer-to-Peer Remittance Systems