– The Future of Remittance is Here 👋

#1 White Label Money Remittance Software Solutions For Secure & Transparent Cross-border Payments

Simplify Your Remittance Process with Our Secure , Custom Money Transfer & Remittance Software Development Solutions

-

Real time Transactions Processing

-

Seamless Ecosystem Integration

-

Mobile Wallet Integration

-

Security and Compliance

-

Automated AML and KYC Integration

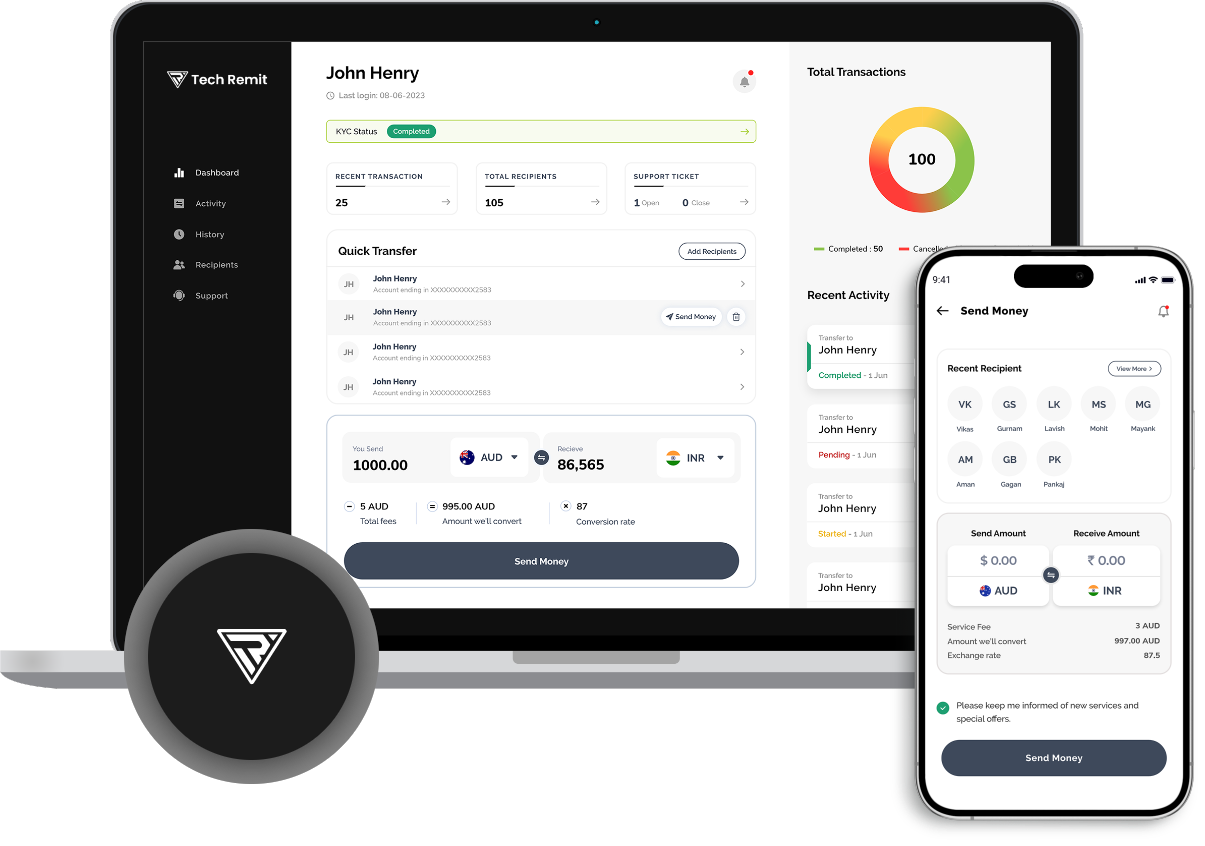

Key Features of Tech Remit's Money Remittance Software

We develop innovative money remittance software solutions that streamline the remittance process. Our expert team of developers utilizes the latest technologies to create secure, scalable platforms that can handle even the most complex international transfers.

Advanced Technology

Built on state of the art Cloud based infrastructure, Tech Remit ensures reliable and efficient money transfers, guaranteeing top-notch performance of our remittance software solutions.

Innovative Integration

Our remittance software platform is seamlessly integrated with industry leading payout partner services. With built in integration, you can start working from day one of the launch.

Convenient Transactions

Automated Finance

Compliance Management

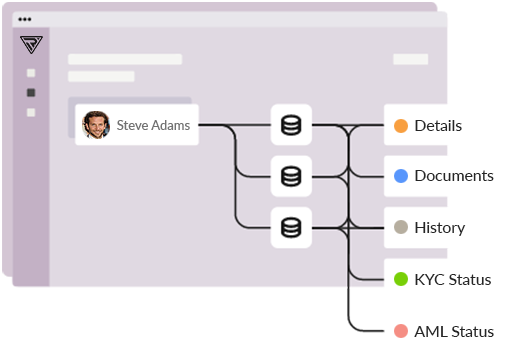

AML and KYC Integration

24/7 Accessibility

Robust and Scalable

White Label Solution

Enjoy a personalized money remittance software solutions tailored to your business needs. Access flawless websites, super apps & dashboards branded for you & ready in no time.

Our Distinctive Features Setting New Standards

Business Intelligence

DocumentsCare

ComplianceCare

Roles Management

Transactions Manager

Notification Display

Dispute Resolution

Invoices Management

comprehensive feature-suite designed to streamline & fortify Money Remittance Software Solutions

Fair to All

We're sparking a revolution, offering Universal solutions for global money management. Crafted for Everyone, our services free your time for what truly matters. Our core values drive excellence, prioritizing Innovation.

All in One

- Simple, Easy to Use, Unique

- Effortless KYC Verification

- Crystal Clear Minimal Fee

- Beneficiaries Auto-Populated forms

- Quick & Secure Transactions

- Transactions Real-Time Tracking

- Logs / History display

- Dedicated Tickets Management

Go Handy!

Unleash Transactions Initiation & Control Beyond Boundaries with our User-Friendly Interface, Mobile-Enabled Dashboard Access.

Advanced Tools to Simplify & Strengthen Money Remittance Software

-

Access ebooks offline

-

Promotions for our valued customers

-

Secure payment options for your convenience

-

Better Funding Access

- Customisable Solution

- Security and Compliance

- Risk Management Engine

- 190+ Currencies

- Role Based Permission Model

- Agent Interface

- Smart Transaction Routing

- Fee Management Engine

- Secure Transaction Processing

- Automatic AML and KYC check

- Payout Partner Integration

- Monitoring and Reporting

- Customer Support Panel

- White Table

Seamless Third-Party Integration

Integrating third-party services has never been easier. As experienced tech team, we recognize that each business has unique requirements and aims to join a payout network to broaden their horizons. Having collaborated with industry leaders, our wealth of experience is at your disposal.

Learn More About Our Policies

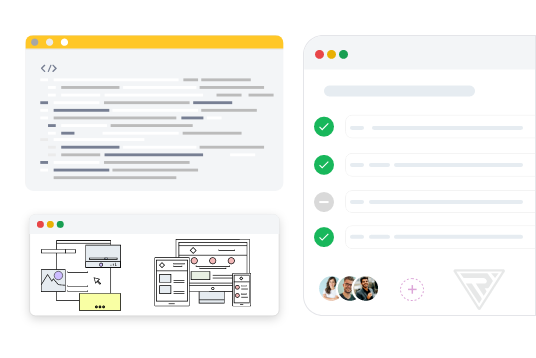

Ready To Use Innovative Solutions

Since, speed to market and always staying ahead of competition is crucial, you can build the best right solution for your business quickly & easily either through our white-label or complete Enterprise Solution. While crafting your platform, we sweat the technicalities for your Success.

Feel Free To Consult UsRisk Management Engine

The Tech Remit Risk Management Engine empowers you to autonomously implement your personalised fraud prevention and risk management strategies. Seamlessly identify and decline fraudulent transactions, and respond proactively to potentially high-risk payments.

Book A Demo To See How It Works

The Ethics Of Privacy

At Tech Remit, your Money & Data is as Important to us as it is to You. We continuously learn new transaction patterns, utilize advanced ecosystems to prevent fraudulent transactions. We’re transparent in how we collect, process & store your data, maintaining World Class Security.

Talk To Our ExpertSave time & energy with our streamlined money transfer & remittance Software Solutions

Operating an international money transfer business has never been easier. Our money transfer and money remittance software applications offer a user-centric interface designed to expedite your cross-border transactions.

Empower Your Business With Tech Remit's Money Remittance Application Development Expertise

Leveraging 18 years of experience in Remittance Software & Money Transfer Software , Tech Remit provides comprehensive consulting and development services to help you bring your money remittance app vision to life.

Expert Consulting Services

Custom remittance software Solutions

Trusted by Growing Remittance Brands Worldwide

Delivering Results for Our Valued Clients in Australia

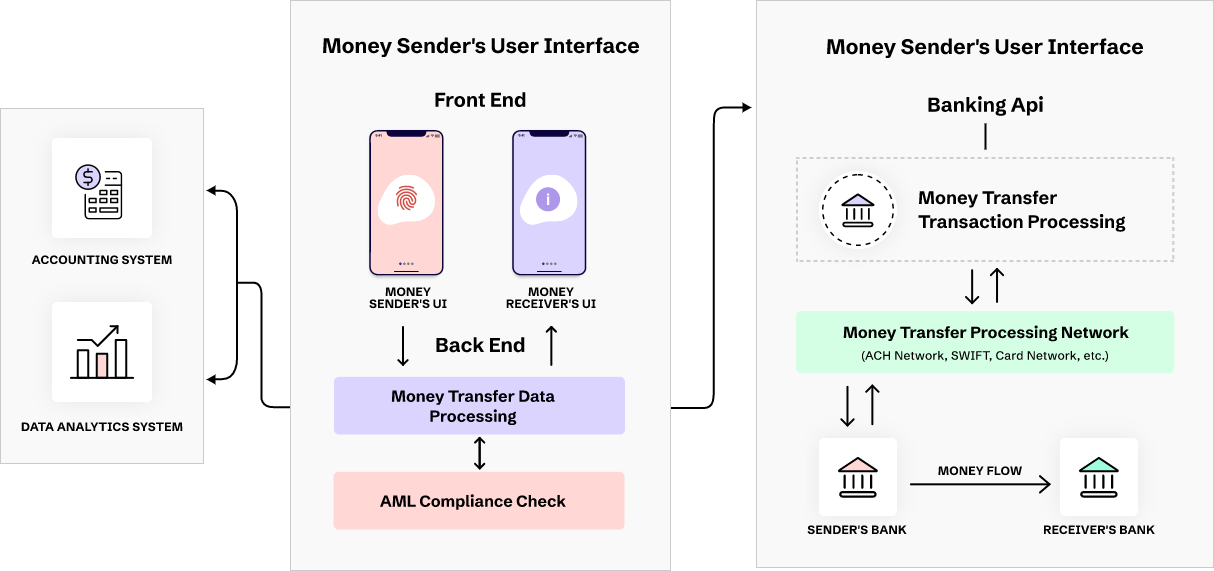

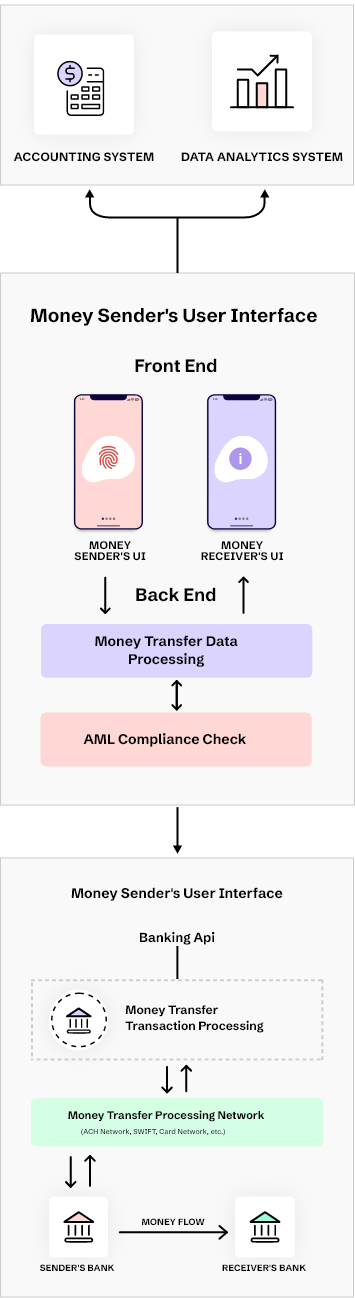

Power Up Your Money Transfer Software With Strategic Integrations

processing, and banking connectivity.

Partner With Tech remit and Experience The Difference

Tech Remit’s team of experts possesses the deep technical expertise and industry knowledge to transform your money Remittance app vision into a reality. We are committed to providing you with high-quality services that empower your business to thrive in the competitive money Remittance landscape.

Embrace seamless money Remittance Software Solutions with Tech Remit.

Thousands of Happy Customers

Maria Rodriguez

Eduardo Martinez

Liam O'Connor

Anna Nguyen

Michael

Key Technologies & Tools For Money Remittance Software Development

Your Curiosity Knows No Bounds Share Your Queries Fearlessly

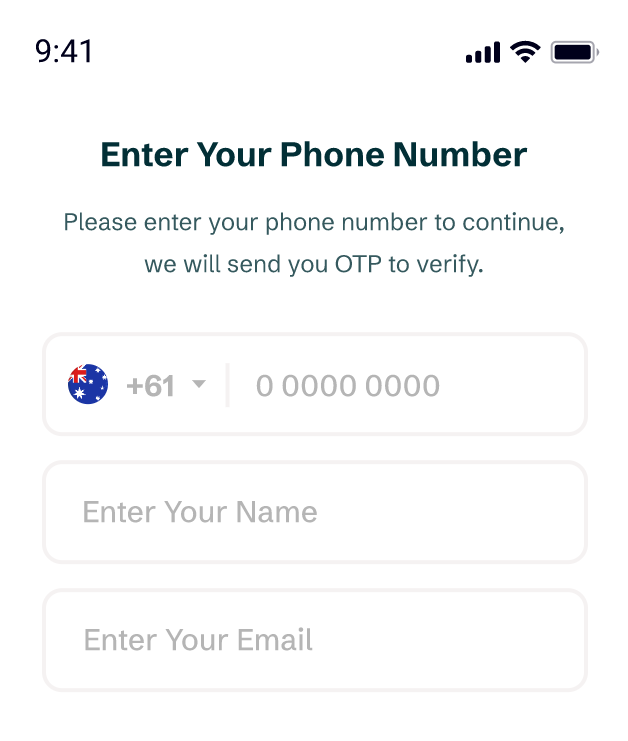

Personal details

Sign up with your full name, email address, mobile phone number, gender, birth date and address.

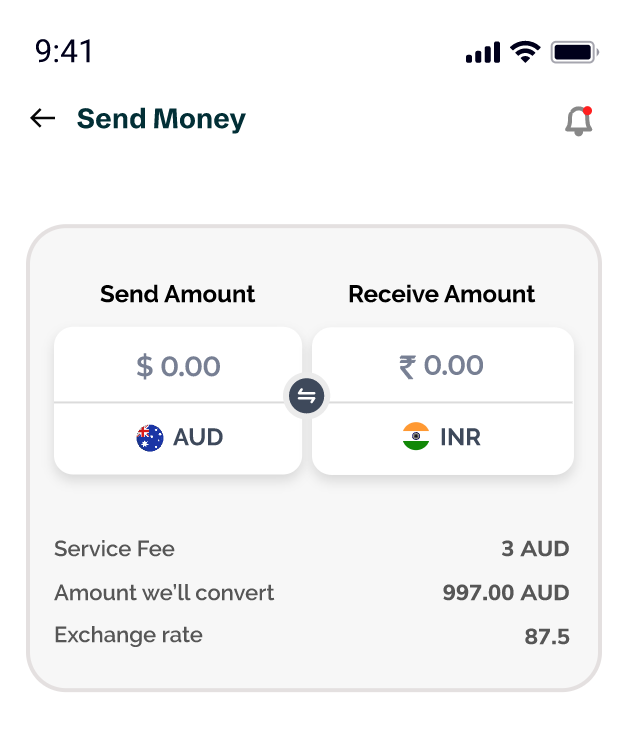

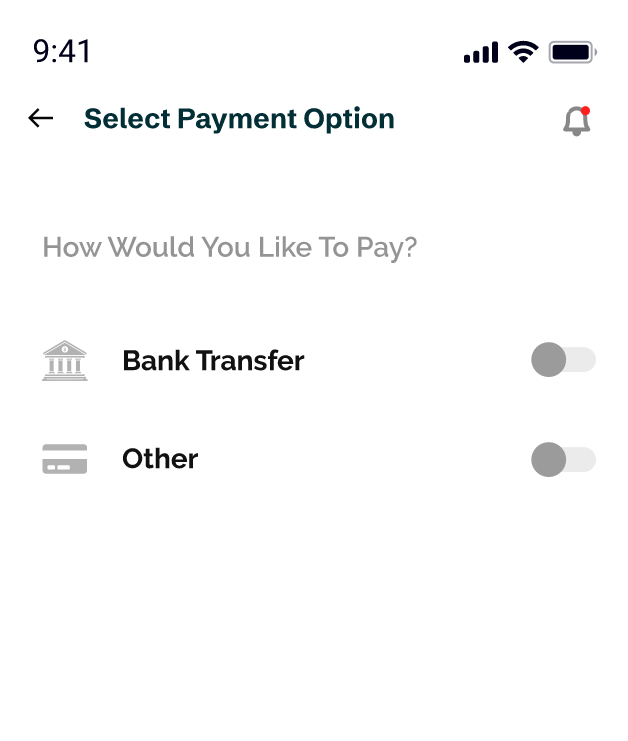

Transfer details

Choose the amount you want to send abroad, select how your receiver wants to get the money, and lastly, how you want to pay. You will always see our fees upfront, the final amount you will pay, and the exact amount your receiver will get.

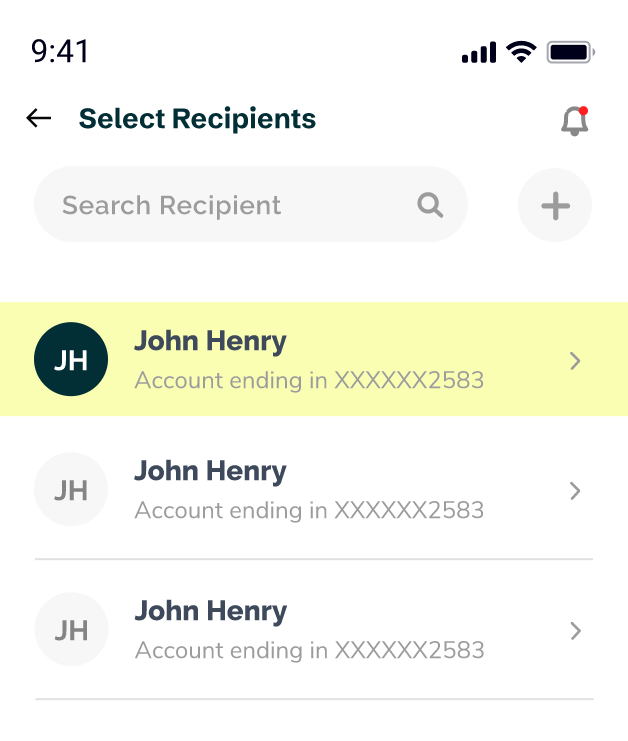

Receiver details

Based on the receive method, we need specific details of your receiver abroad. The receiver’s full name, mobile number and email address are always required to send money.