Tech Remit’s API

Welcome to Tech Remit’s robust API Developer Portal, designed to empower developers like you to seamlessly integrate our cutting-edge remittance solutions into your applications, websites and systems.

By leveraging our API, you can unlock a world of possibilities in cross-border transactions and financial services.

It’s never been easier to scale your business globally!

Why Choose Tech Remit's API?

Innovation

Simplicity

Global Reach

Customization

Key Features

Secure Transactions

Real-time Data

Comprehensive Documentation

Getting Started

Register

Authenticate

Integrate

Test

Go Live

Support & Assistance

Our dedicated developer support team is here to assist you at every step of the integration process. If you encounter any issues or have questions, don’t hesitate to reach out us at ‘[email protected]‘

Join us in revolutionizing cross-border transactions with Tech Remit’s API – where innovation meets simplicity.

Explore Our Sandbox Environment

Introduction

What is a Sandbox Environment?

Key Features

Realistic Simulation

Secure and Isolated

Easy Integration

Comprehensive Documentation

Benefits of Using Our Sandbox

Accelerated Development

Cost Efficiency

Getting Started

To begin harnessing the power of our sandbox, simply sign up, create your developer account and this will enable you to generate API keys and make test transactions without moving real money.

We provide everything you need for a great API integration experience – from an interactive API Explorer, Automatic Mock Servers, OpenAPI designer, API Console, Code Samples in your preferred languages and comprehensive examples.

Once your code is tested and you’re ready to migrate to production, send us an email to ‘[email protected]‘ and we will help you complete your setup.

Explore, experiment, and turn your financial innovations into reality.

Have Questions?

If you have any questions or need assistance while working in our sandbox, our dedicated support team is here to help. Feel free to reach out with your inquiries.

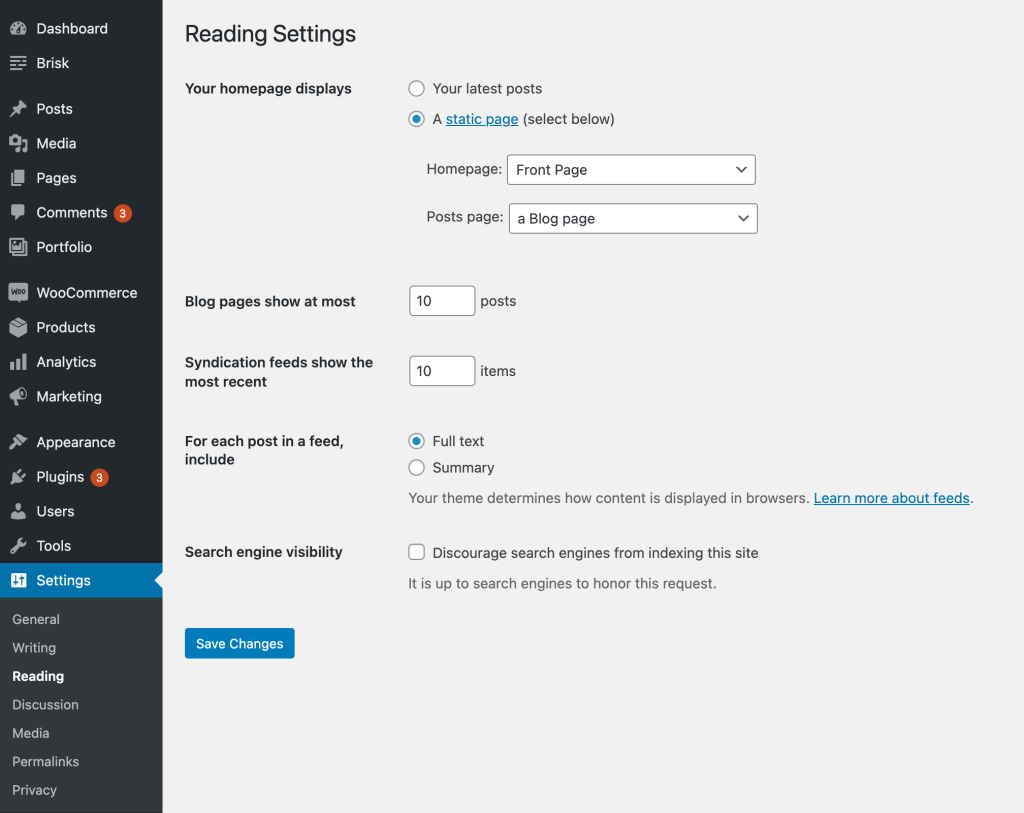

Restful and HTTP URLs

Key Features

RESTful Design

HTTP URLs

Error Handling

Getting Started

To start using our API and access our RESTful and HTTP endpoints, refer to our developer documentation. You’ll find everything you need to integrate seamlessly with Tech Remit.

Whether you’re a seasoned developer or new to API integration, our RESTful and HTTP URLs are designed to simplify the integration process and provide you with the tools you need to create exceptional financial applications.

Our modern Payment API is based on RESTful architecture and uses predictable, resource-oriented standard HTTP URLs.

Our REST API also leverages “Digital Invoices”.

Our Send and Request payment APIs will be able to service different models of payments. If you have any questions or need assistance, don’t hesitate to reach out to our dedicated developer support team at ‘[email protected]‘. We’re here to help you make the most of Tech Remit’s capabilities.

OAuth2 Integration

Key Features

Secure Authorization

User Consent

Access Tokens

Refresh Tokens

Scopes

Getting Started

Authorization Code Flow

Implicit Flow

Client Credentials Flow

The OAuth2 protocol defines a set of access rights for applications called Scopes, that allows different applications to have different access rights to certain API endpoints. API Tokens are generated according to the authorized scopes. API endpoints orchestrate transfers among bank accounts, digital wallets and virtual accounts in a secure and reliable environment.

If you have any questions or require assistance with OAuth2 integration, our developer support team is ready to help, contact us at ‘[email protected]‘.

We’re committed to making your integration process smooth and secure.

Stay Connected in Real Time

At Tech Remit, we believe in keeping you informed and empowered in real time. Our Webhooks feature is designed to do just that.

Webhooks are your direct line of communication with our platform, allowing you to receive instant updates and notifications regarding transactions, account activity, and more. It’s like having your finger on the pulse of your financial operations.

Key Features

Real-Time Updates

Customizable Alerts

How It Works

Get Started with Webhooks

Experience Real-Time Connectivity

With Webhooks, you’re always connected to your financial operations. Say goodbye to delays and hello to instant insights. Stay ahead of the game with Tech Remit Webhooks.

Ready to get started? Log in to your account and configure your Webhooks today!

Unlock Seamless Integration with Zapier

What is Zapier?

Key Benefits

Endless Possibilities

Efficiency at its Best

Custom Workflows

How It Works

Getting Started

Sign Up

Connect Tech Remit

Create Zaps

Build custom Zaps to automate tasks and processes.

Sit Back and Relax: Let Zapier handle the rest, ensuring your financial operations run smoothly.

Start Integrating Today

Have Questions?

Our dedicated support team is here to assist you every step of the way. If you have any questions or need assistance with setting up your integrations, don’t hesitate to reach out to us at ‘[email protected]‘.

Ready to simplify your financial operations? Get started with Tech Remit and Zapier now!

JavaScript SDKs for Seamless Integration

Introduction

Key Benefits

Effortless Integration

Enhanced Functionality

Customization

Features

User-Friendly Documentation

Cross-Platform Compatibility

Continuous Updates

Getting Started

Integrating Tech Remit’s JavaScript SDKs is as easy as 1-2-3. Follow our step-by-step guide to get started today. If you have any questions or need assistance, our dedicated support team is here to help.

By taking advantage of our simple, secure, embeddable UI component SDK interface, developers can easily access the TechRemit Global Payments API while leaving HTTP, JSON, and OAuth2 token handling to the SDK.

JSON-encoded formats leverage enhanced filtering capabilities that offer you greater flexibility so that you can do more with one call.

Ready to Transform Your Financial Services?

Get in Touch

Call to Action

Ready to supercharge your financial services? Start integrating with our JavaScript SDKs now.

Experience innovation. Experience Tech Remit.

Introduction

ISO 4217 Currency Codes

ISO 3166-2 Country Codes

Why ISO Standards Matter

Error Reduction

Cross-Border Convenience

Regulatory Compliance

Making Your Transactions Effortless

Ready to Send Money Internationally?

Get in Touch

If you have any questions or need further information about our use of ISO standards, please don’t hesitate to contact our support team at ‘[email protected]‘. We’re here to assist you in navigating the world of international remittances.

Call to Action

Start sending money globally with confidence. Join Tech Remit today.

Experience innovation. Experience Tech Remit.

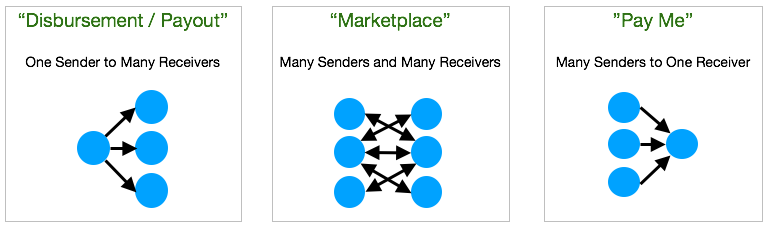

Diverse Payment Models for Seamless Transactions

Introduction

Explore our Payment Models

One-to-Many Payments

Empowering Distributors and Payouts

Typical use cases are

Batch payments

Contractor payments

Mass payments

Use case: Send Money

API: Payment-Controller

Many-to-One Payments

Simplifying Collection and Consolidation

Typical use cases are

Invoicing software

Account Receivables

Use case: Request Money

API: Invoice-Controller

Many-to-Many Payments

Enabling Complex Financial Ecosystems

Typical use cases are

Supplier websites. e.g.. Amazon, Flipkart

Platforms where your customers have many businesses (domestic or international) to pay.

Use case: Send Money & Request Money

API: Payment-Controller & Invoice-Controller

Key Features of Our Payment Models

Real-time Processing

Compliance and Security

Scalability

Tailored Solutions for Your Business

Getting Started

Join the Tech Remit Community

Call to Action

Unlock the potential of our diverse payment models. Connect with Tech Remit at ‘[email protected]‘ to simplify and streamline your payment processes.

Innovation without boundaries. Tech Remit.

Introduction

Explore the Possibilities With Tech Remit's Gate APIs, you can

1. Initiate Transactions

2. Retrieve Transaction Details

3. Access Exchange Rates

4. Automate Reporting

5. Build Custom Solutions

Getting Started

Open Banking API

Business API

Merchant API

Accept online payments (Card Not Present) by debit or credit cards, and also to manage the orders and customers.

You can test the Merchant API in Postman

Join the Tech Remit Community

Call to Action

Ready to integrate with Tech Remit’s Gate APIs and transform your financial services? Contact our integration experts today at ‘[email protected]’ and let’s embark on this journey of innovation together.

Empower your business with Tech Remit’s Gate APIs. Seamlessly connect, simplify transactions.

Your Financial Safety is Our Priority

Introduction

Our Security Commitment

1. Data Encryption

We employ state-of-the-art encryption technology to secure your data during transmission. Your information is protected with advanced encryption protocols, keeping it confidential and inaccessible to unauthorized parties.

SSL encryption ensures that information cannot be intercepted.

All data collected and stored, including account numbers, Social Security Numbers, and other PII (Personally identifiable information) is SSL encrypted.

All calls to the API are protected by encryption keys.

The keys are SHA256 encrypted and contain a randomizing component so repeat calls have different keys with a limited lifetime.

The Payer & Supplier portals are secured in the same way.

2. Fraud Detection

Our real-time fraud detection systems continuously monitor transactions for any suspicious activity. If any irregularities are detected, our automated systems trigger alerts for immediate investigation and action.

Keys are obtained using an API call.

The API call must come from a white-listed IP address. All API calls (including calls to obtain a short term key) are white-listed. All other calls will be denied.

3. Compliance with Regulations

Security in Every Transaction

Continuous Improvement

Contact Us

Your Financial Security, Our Priority

Reliable Performance for Seamless Transactions

Introduction

The Tech Remit Runtime Advantage

1. 24*7 Availability

2. Scalability

3. Redundancy and Failover

4. Real-time Updates

Advanced Technology Stack

Your Experience, Our Focus

Get Started

Contact Us

If you have any questions about our runtime environment or need assistance with your transactions, our dedicated support team is here to help. Feel free to reach out to us at ‘[email protected]‘ and we’ll be happy to assist you.